The Loudoun County Board of Supervisors recently approved an application by JLB Realty LLC to build a 230-unit multifamily residential development on an undeveloped parcel in South Riding, Virginia. The South Riding development was originally approved in the 1990s and is known as one of the finest large-scale communities in Loudoun County. As with many planned developments, however, there remain small pockets of undeveloped land which require creative solutions for “infill” development. In order to accommodate the project, JLB requested a rezoning to the R-24 Multi-Family Residential zoning district, as well as two zoning modifications for a road corridor buffer type adjustment and an increase in building height for one of the buildings.

The property is composed of approximately 19.32 acres and is located south of Route 50 along Defender Drive. South Riding Boulevard lies to the east and Elk Lick Road to the west of the project.

JLB’s design team created a highly-amenitized project that consists of 230 multifamily rental units located within four buildings. The buildings are configured to face internally to a central courtyard with lounge areas and a pool for the residents to enjoy. A state-of-the-art indoor fitness center will also provide year-round indoor recreational space for the future residents. The community will have ample parking, with covered tandem parking spaces. The proposed development will contain thoughtfully designed amenity areas and active recreation space. Enhanced landscaping and superior architectural design provided throughout the development will increase the visual appeal for the residents and surrounding community.

Loudoun County has long struggled with the issue of affordable housing units. The project is expected to provide approximately 168 one-bedroom units, 15 Affordable Dwelling Units (ADUs) and nine Unmet Housing Needs Units (UNHUs). JLB committed to provide 10 percent of all units as affordable, which far exceeds Loudoun County’s requirement since the project was technically exempt from providing any affordable units. The proposed rental units will help address a needed housing product in this area of the County, which sorely needs smaller-sized units, and will respond to the demand for a continuum of housing in the sought-after South Riding community.

A key component of this project is JLB’s conveyance of approximately 10.41 acres to the South Riding Proprietary to be used as open space. The South Riding Proprietary’s Board of Directors fully supports the project and was actively involved throughout the rezoning process. In exchange for this conveyance, the project will be annexed into the Proprietary allowing future residents to take advantage of the South Riding open space and amenities. The Proprietary plans to use the open space area as a soccer field.

JLB is particularly proud of the many pedestrian-friendly features throughout the project, including pedestrian connections to active recreation areas, a natural surface trail connection to Elk Lick Park, a “missing link” sidewalk to Tall Cedars Parkway, crosswalks, and additional sidewalk connections. This project will also help to ensure the success of local businesses by increasing pedestrian traffic to the shops, restaurants, fitness center, and other commercial uses located along Defender Drive. Attractive buffering will be provided and native vegetation will be featured in the onsite landscaping as well as tree conservation areas.

The resolution of traffic concerns was a crucial factor in obtaining approval of the project. The South Riding/Route 50 intersection is operating at a “failing” level of service. The traffic report prepared by Wells & Associates concluded that the project would have a minimal impact on the intersection generating only 1.6 percent of the overall trips. County planners recommended that the developer pay almost $1 million toward improvements at the intersection based on a legacy proffer from the original South Riding rezoning. Walsh Colucci was able to assist JLB in successfully negotiating to contribute half of that cost. This revised contribution accounts for the actual development area proposed by the application and reflects JLB’s conveyance of 10.41 acres of open space to the South Riding Proprietary.

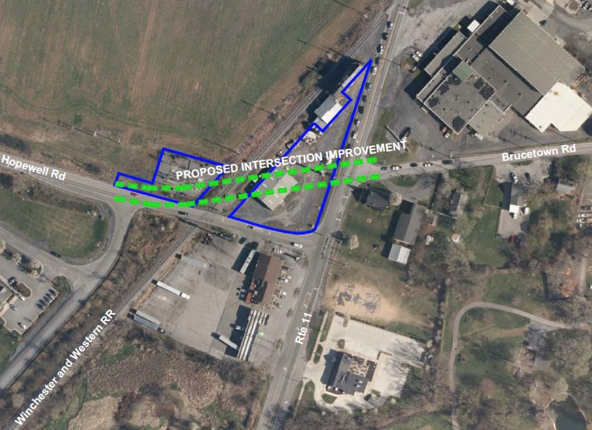

The Defender West/South Riding Boulevard intersection is part of Loudoun County’s Intersection Improvement Program (IIP). However, as noted by Supervisor Letourneau, the processes necessary to obtain County funding for the intersection could take several years to complete. The project team was able to successfully mitigate Supervisor Letourneau’s concerns by agreeing to install the traffic signal if it is recommended by VDOT. In order to ensure that the signal is operational as soon as possible, the project team also agreed to complete the signal’s design prior to receiving VDOT approval for the signal. Consequently, the signal will likely be provided two to four years earlier than it otherwise would be, making the roadway safer for future Defender West residents and the overall South Riding community.

The result of these efforts will be a blueprint for how to utilize “infill” development areas to provide a premier development on under-utilized property and to expand the County’s affordable housing options.