On January 15, 2025, the Leesburg Town Council approved major updates to the Crescent District Master Plan (the “Plan”) maintaining the overall vision of the Plan while incorporating adjustments meant to account for the market realities of the post-COVID era and current neighborhood interests and needs.

Updates focus on open space, walkability, and revitalizing mixed use development.

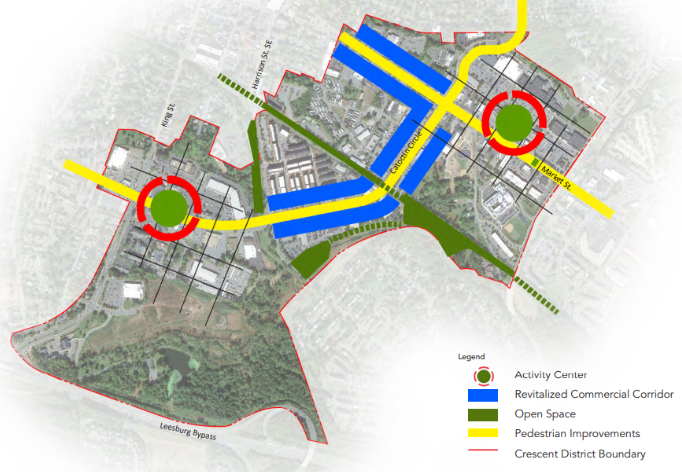

The updated Plan centers on two pedestrian-oriented “activity centers” connected by a revitalized commercial corridor that promotes walkability and open space.

Crescent District Organizational Framework (Crescent District Master Plan, January 14, 2025, pg. 69)

Citing a struggling retail environment post-pandemic, lack of housing throughout the County, and feedback from stakeholders and neighbors highlighting the desire for increased walkability, the Plan adopts a medium density approach incorporating a balance of residential developments and commercial and retail services centered around open space features.

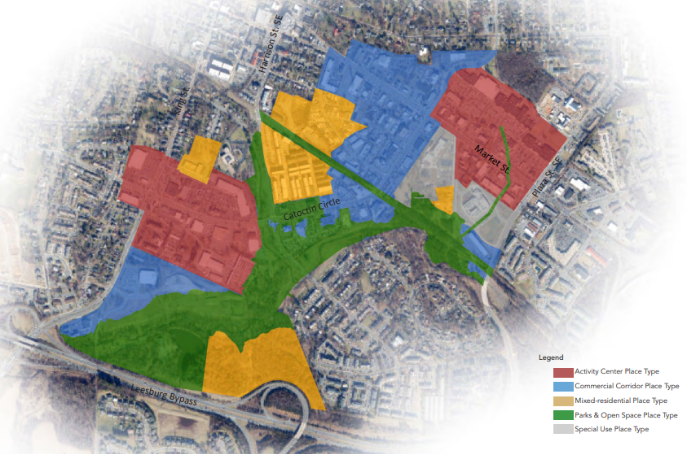

The Plan implements this vision by designating five place types.

The Activity Center Place Type incorporates a mixed-use plan including multi-family residential, employment and office space, retail, and grocery and medical facilities. Grounding these features is intentional open space to facilitate walkability and increased social connections throughout the Centers.

Crescent District Place Types (Crescent District Master Plan, January 14, 2025, pg. 74)

The Commercial Corridor Place Types incorporate commercial activity of the Activity Centers, supporting uses including office and employment, retail, and school and community facilities, while transitioning to the Mixed-Residential Place Type, where residential multifamily developments take priority, bordered by natural barriers like streams and the W&OD Trail. Parks & Open Space are integrated throughout, connecting the Crescent District with green space and access to the W&OD.

Town Zoning Ordinance now out-of-step with Master Plan?

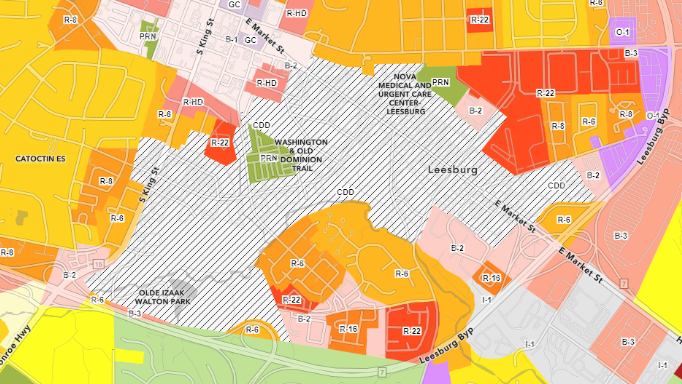

The updated Master Plan also shrinks the overall size of the area subject to the Master Plan. Consequently, the area zoned to the Crescent Design District under the Town of Leesburg Zoning Ordinance (the “Zoning Ordinance”) now exceeds the Master Plan area. Several areas of the zoning map now exist independently of the Plan map:

Town Zoning Map, Crescent Design District shown in diagonal hatching.

The Zoning Ordinance established the Crescent Design District in 2013 with the goal of implementing the vision of the Master Plan, which could result in a proposal to amend the text of the Zoning Ordinance in the coming months to reconcile the Master Plan and the Zoning Ordinance.

Please contact the Loudoun Office of Walsh Colucci if you have any questions about properties located in the Crescent District.

This article was written by Anna Ritter, an Associate with the Land Use & Zoning practice group out of the Loudoun Office.